Simple MTD compliance for self-employed professionals.

Otis helps you meet HMRC's quarterly reporting requirements without disrupting your existing workflow or forcing you into complex accounting software.

What is MTD for Self-Employed & Sole Traders?

Making Tax Digital for Income Tax is launching in April 2026, and most self-employed individuals and sole traders earning above the income thresholds will need to send digital updates to HMRC four times a year.

This isn't about filing four tax returns or submitting full accounts. It's simply quarterly snapshots of your business income and expenses, plus a final declaration at the end of the tax year to confirm everything is accurate.

Why Has HMRC Written to Me About MTD?

If you've received a letter from HMRC about Making Tax Digital, don't panic. HMRC has started contacting sole traders and self-employed individuals whose income exceeded the relevant thresholds in their recent Self Assessment returns.

The letter is simply informing you that you'll need to start using MTD-compatible software to report your income and expenses digitally from April 2026. This is part of HMRC's effort to modernise the tax system and reduce errors that cost billions in lost tax revenue each year.

What You Should Do:

- Don't ignore the letter - HMRC won't automatically register you

- Check your qualifying income to confirm you're in scope

- Start researching MTD-compatible software options like Otis

- Consider signing up early to avoid the last-minute rush

- Speak to your accountant or bookkeeper if you have one

Remember, receiving a letter doesn't mean you've done anything wrong. HMRC is simply preparing you for the upcoming changes and giving you time to get ready.

How Quarterly Updates Work

Quarterly updates are straightforward summaries. Every three months, you'll tell HMRC:

- Your business income for the quarter

- Your allowable business expenses

- Any significant changes to your business activities

These updates aren't final or legally binding. You can make adjustments and corrections at the end of the tax year. Otis makes submitting these updates quick and hassle-free, so you can focus on running your business.

MTD Income Thresholds for Sole Traders

As a sole trader or self-employed individual, you'll need to follow Making Tax Digital for Income Tax if your total qualifying income from self-employment and/or property exceeds these thresholds:

From 6 April 2026

You're affected if your qualifying income is over £50,000.

From 6 April 2027

You're affected if your qualifying income is over £30,000.

From 6 April 2028

You're affected if your qualifying income is over £20,000.

Important Notes:

- • Qualifying income means gross income (before expenses), not profit

- • If you have both self-employment and rental income, you must combine them

- • HMRC will check your previous tax returns to determine if you're in scope

- • Below £20,000? You can still voluntarily sign up for MTD if you wish

Why Many Self-Employed People Still Use Spreadsheets

If you're a freelancer, consultant, or small trader, spreadsheets often work perfectly for tracking income and expenses. They're flexible, familiar, and you don't need extensive training to use them effectively.

MTD doesn't force you to abandon your current system and adopt complex accounting software. It simply requires digital submission. That's why Otis works alongside your existing methods rather than replacing them entirely.

Introducing Otis (No Hard Sell, We Promise)

Otis isn't a full-scale accounting platform trying to take over your entire financial life. If you're a hands-on business owner who prefers managing things yourself, Otis is built with you in mind.

Keep your spreadsheet. Track income and expenses however works best for you. Otis simply bridges the gap between your records and HMRC's new digital requirements.

You can also download our free spreadsheet template or read our software guide to see just how straightforward getting started really is.

Finding Otis Through the HMRC Software Finder

HMRC provides a software finder tool to help self-employed individuals find solutions that meet MTD requirements. While we'd love for you to choose Otis, here's how to navigate the tool and explore your options.

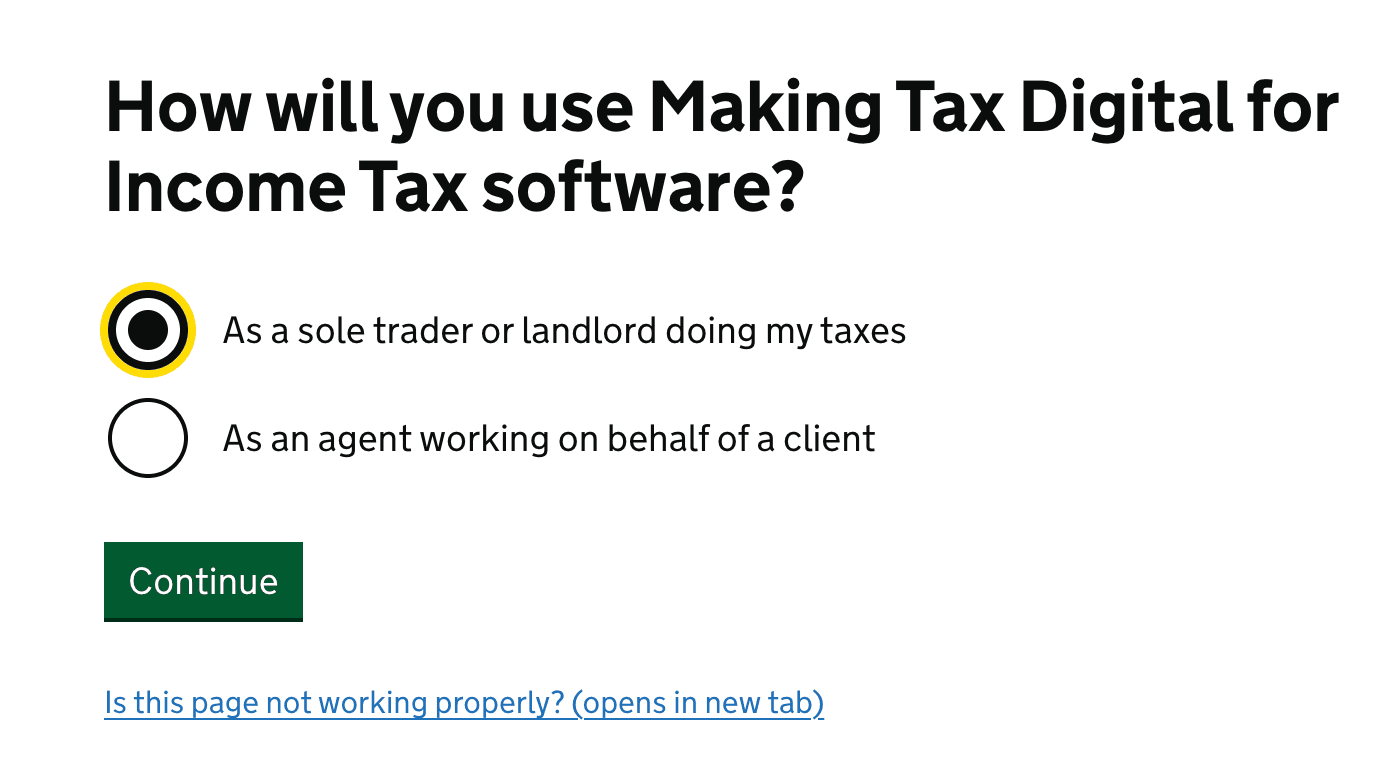

Step 1 — Choose "Sole trader or landlord doing their taxes"

This filters the tool to show software designed for individual tax reporting rather than corporate solutions.

Step 2 — Select "Self-employed" as your income type

This narrows results to software specifically designed for sole traders and self-employed individuals. If you also have rental income, you can select both options.

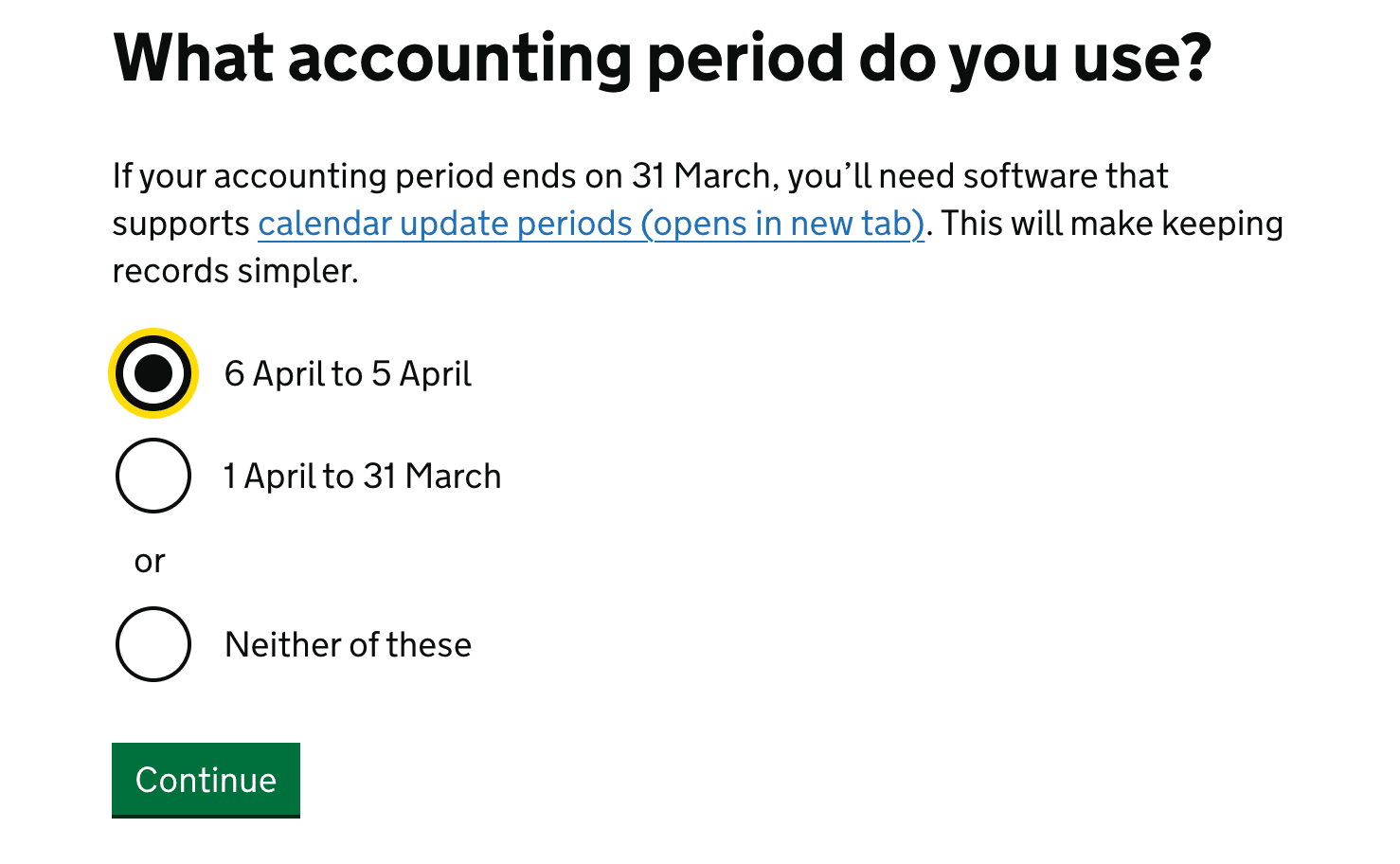

Step 3 — Choose your accounting period

Select whether you follow the standard tax year (6 April to 5 April) or use a custom accounting period. Otis works with both options.

Step 4 — Specify any additional requirements

Consider whether you need to also report any dividends or interest or even pension contributions to HMRC.

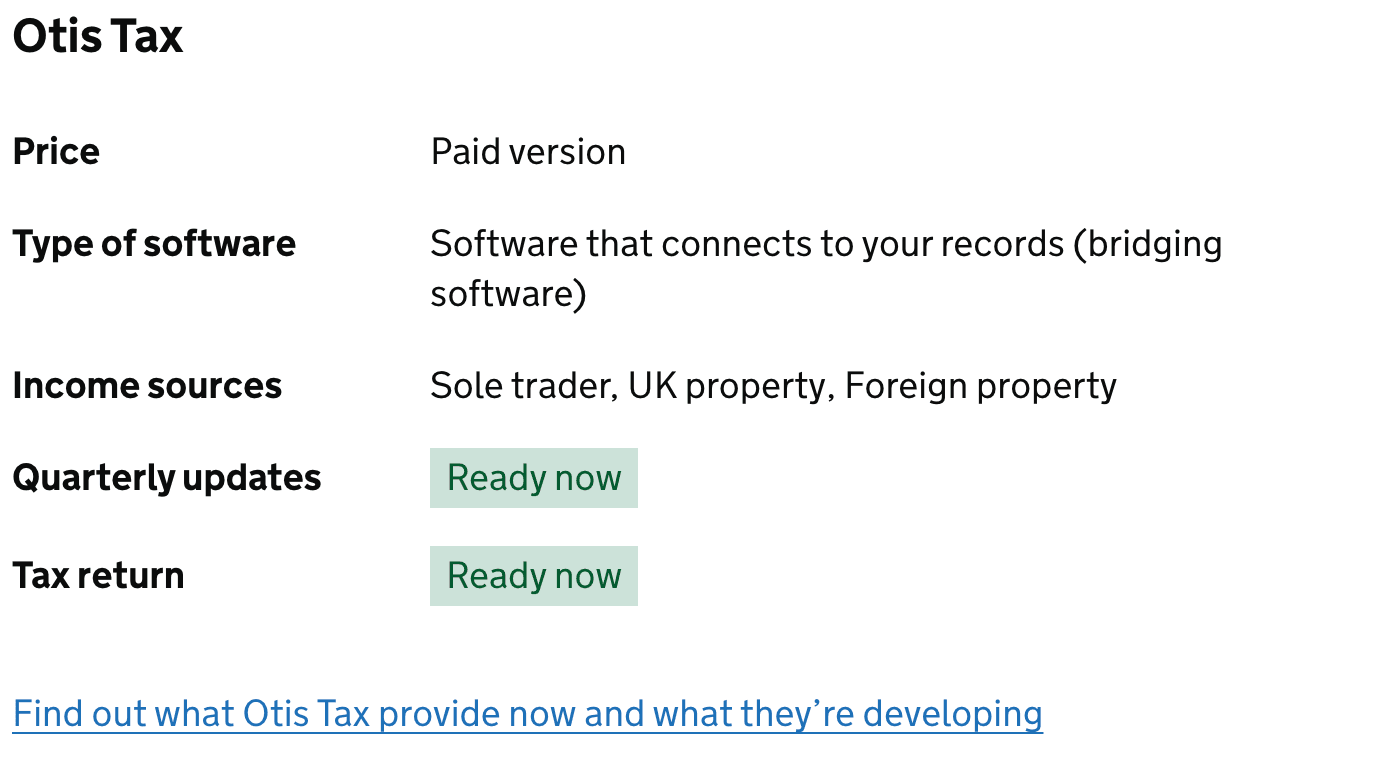

Final Step — Review bridging software options

Look for bridging software like Otis that connects your existing records to HMRC without requiring you to learn complex accounting software.

Ready to Get Started?

If you're thinking about getting ahead of the MTD requirements, get early access to one of the simplest MTD solutions available for self-employed professionals.