Simple MTD made for landlords who prefer spreadsheets.

Otis exists to help you send HMRC the updates they require — without changing how you already manage your rental income.

What is MTD for Landlords?

Making Tax Digital for Income Tax is coming in 2026, and most landlords with rental income above the thresholds will need to send digital updates to HMRC four times a year.

Not detailed accounts. Not a full tax return. Just quarterly snapshots of your income and expenses — and a final declaration at year end.

How Quarterly Updates Work

Quarterly updates are simple outlines. Every 3 months, you tell HMRC:

- How much rent you received

- What your expenses were

- Any changes to your property business

They're not final or binding — you can fix everything at the end of the tax year. Otis just makes sending them quick and hassle-free.

MTD Thresholds for Landlords

As a landlord, you’ll have to follow Making Tax Digital for Income Tax if your total rental income (UK and/or overseas) exceeds the following thresholds:

From 6 April 2026

You’re affected if your total property income is over £50,000.

From 6 April 2027

You’re affected if your total property income is over £30,000.

These thresholds apply across all your rental properties combined, not per property.

Why So Many Landlords Still Use Spreadsheets

If you’ve only got one or two rental properties, a spreadsheet works perfectly. It’s fast, flexible, and you already know how to use it.

MTD doesn’t force you to switch to full accounting software — it just requires digital submission. That’s why Otis works with your spreadsheets instead of replacing them.

Introducing Otis (Without the Hard Sell)

Otis is not a massive accounting platform. It’s not trying to take over your finances. If you’re a hands-on landlord who prefers to manage things yourself, Otis is designed for you.

You keep your spreadsheet. You track rent however you like. Otis just connects the dots between your records and HMRC.

You can also download our free spreadsheet template or read our software guide to see how easy this all is to get started.

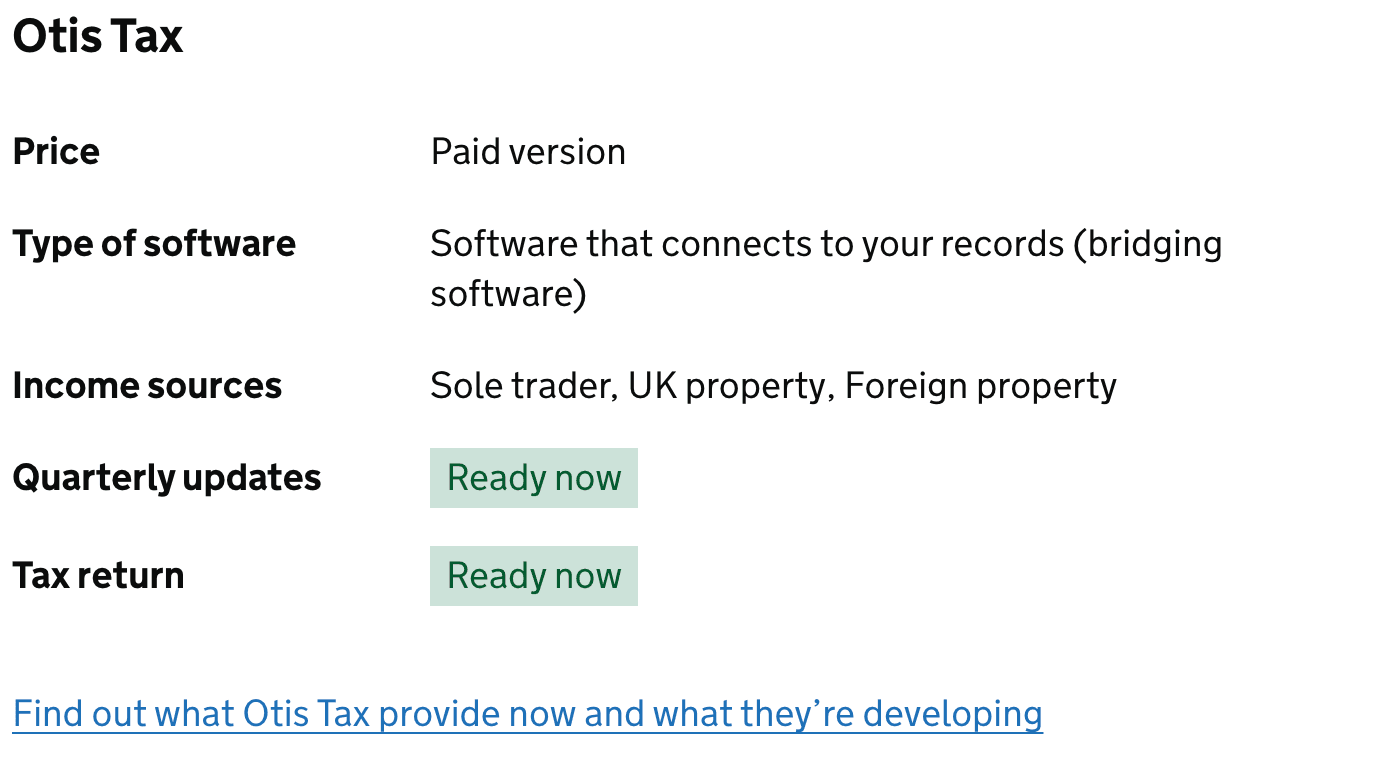

Finding Otis Through the HMRC Tool

HMRC provides a software finder tool to help landlords find software that meets MTD requirements. Not that you would want to look elsewhere, but if you do, here's how to navigate through to the tool - and find Otis 😉 in a few easy steps.

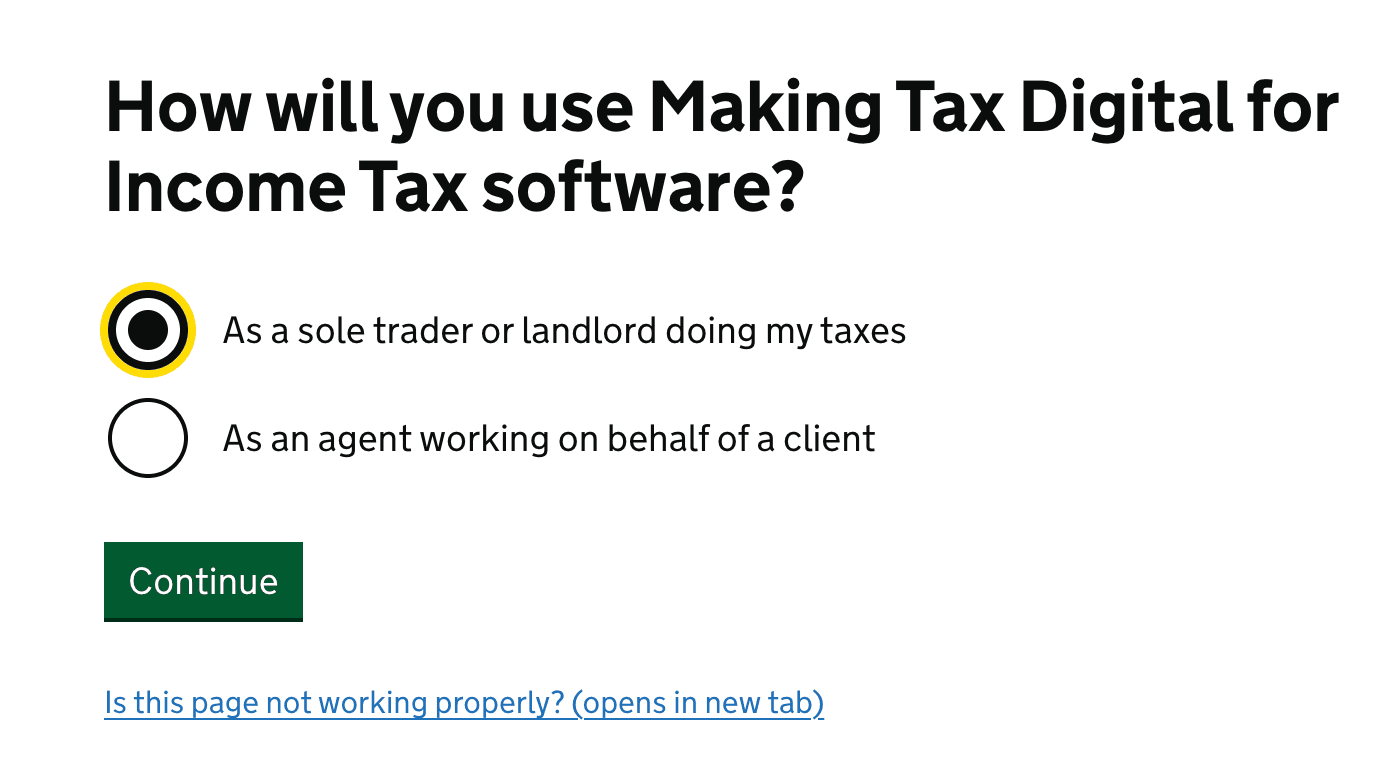

Step 1 — Choose “Sole trader or landlord doing their taxes”

This tells HMRC you want software for quarterly landlord updates.

Step 2 — Select “Renting out a UK/foreign property (landlord)”

This filters the tool specifically to property-related MTD software. Otis for what it is worth, is designed for landlords with properties in the UK and abroad.

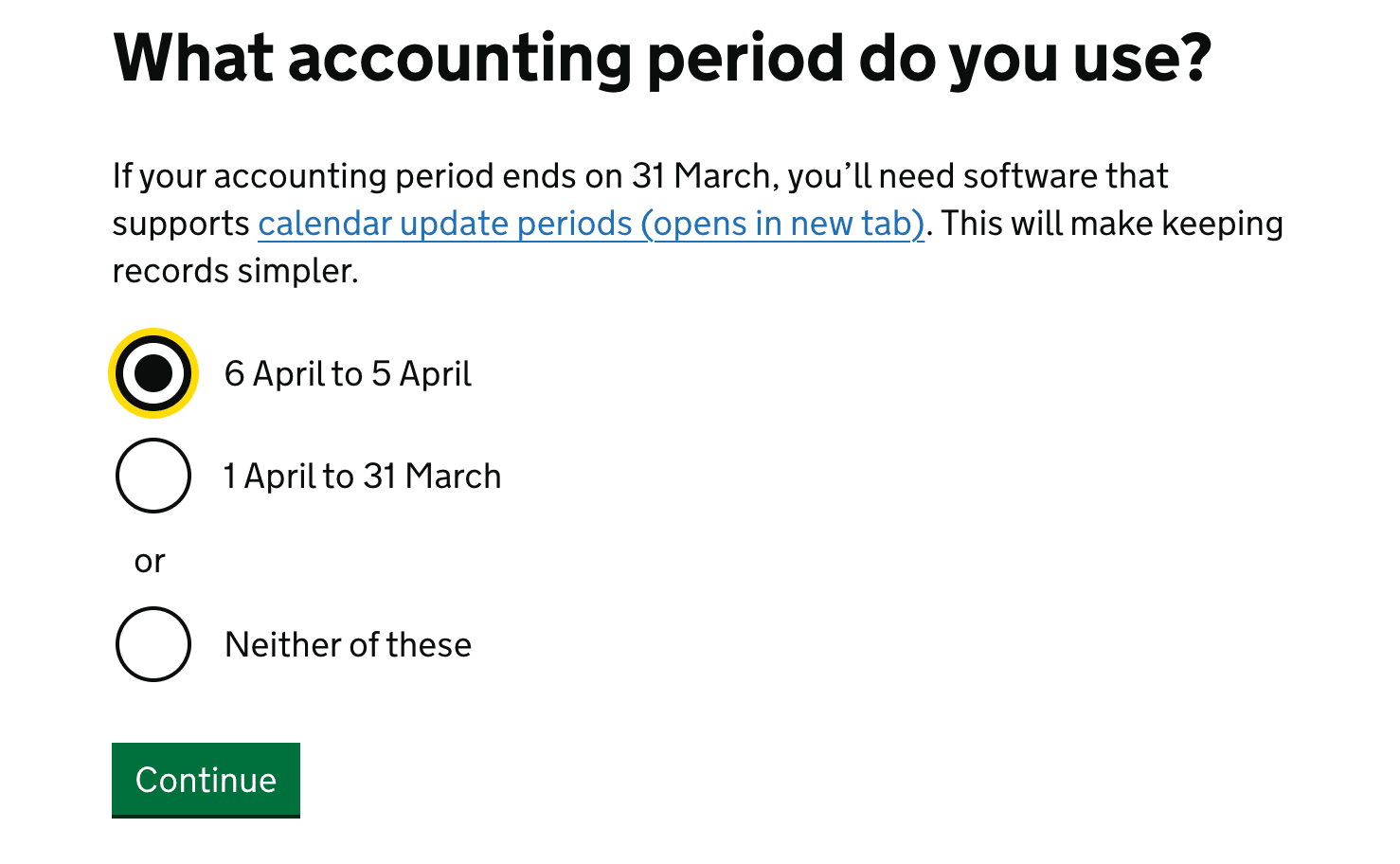

Step 3 — Pick “Your accounting period”

Select the accounting period that your rental income runs to, as a bonus Otis works with either of these options.

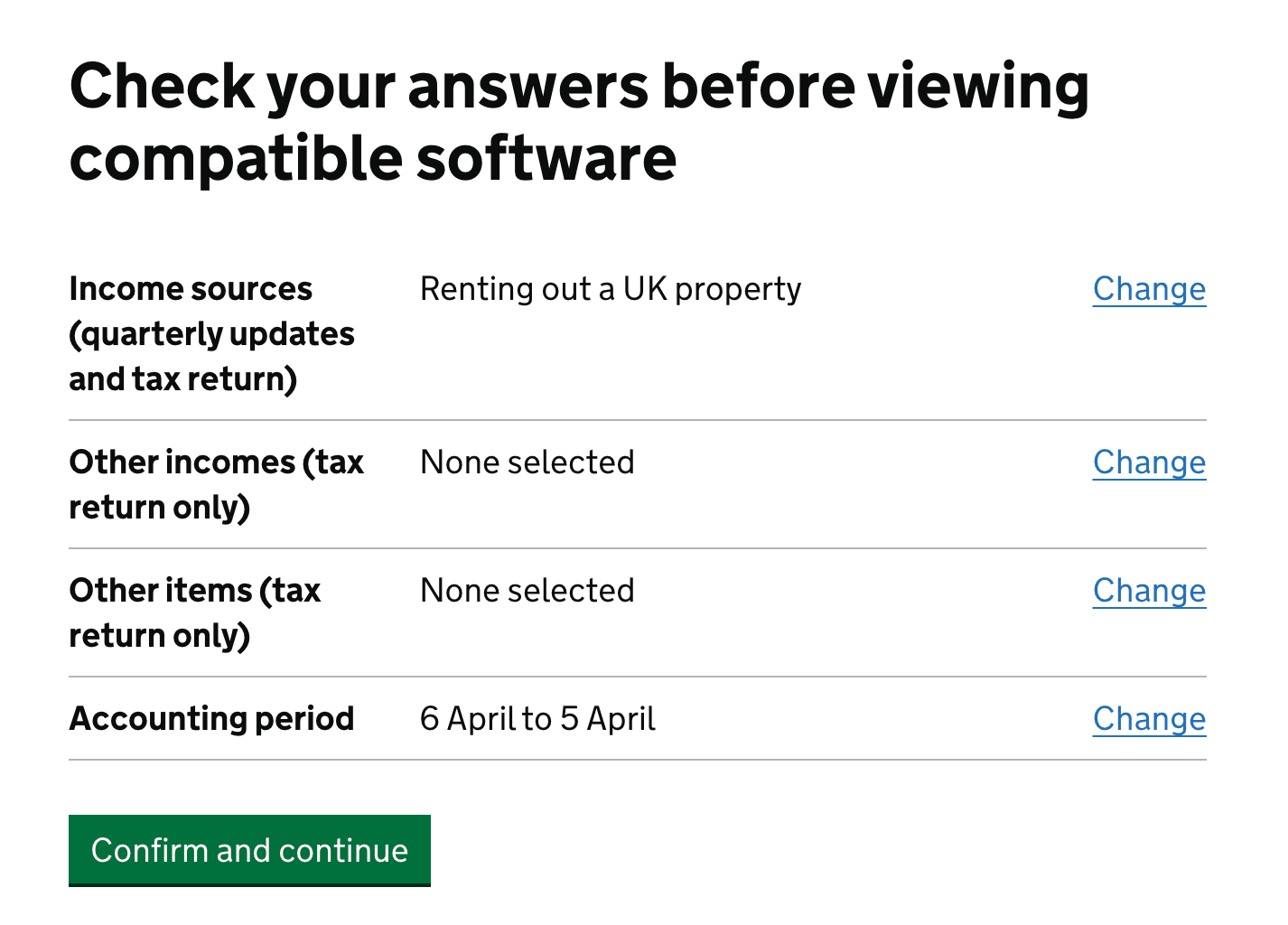

Step 4 onwards — Confirm any other requirements

This narrows the results to simple, submission-focused tools like Otis.

Final step — Navigate to bridging software options

This narrows the results to simple, submission-focused tools like Otis that are designed for landlords.

Ready to Get Started?

If you're reading this and thinking you don't want to miss out, get early access to one of the simplest MTD solutions for landlords.